This is my brutally honest account of battling college debt for decades.

The year is 1995.

Instead of me dropping out of high school due to listless discontent, my guidance counselor offered a plan. By running the numbers and plotting a heavy course load Mr. August showed me how I could defer my feelings of aimlessness and make it through the schooling gauntlet to graduation. With ten classes a day I could graduate a whole year early and lop twelve months off what I felt was a sentence in purgatory. This was ambitious, but it was hope! Plus I’ve always liked doing things differently. A few years earlier I convinced school officials to allow me to skip lunch, drop a class and shorten my school day in junior high. I left class at 12:45PM to work at a local deli.

At age 15 I committed to this packed schedule in addition to keeping up with my participation on the school rowing team, and at 16 I was done. I had skipped my prom and graduation, but earned my diploma from Newburgh High School. I was now an adult(ish), and free to do as I like.

But now what?

When my initial plan to go to college in NYC fell through, I went with option B. While rarely glorified in movie montages, this included… staying at my parent’s house, working part-time jobs at Sears photo studio, pushing carts at Home Depot, and ringing in guests at a local hotel (wha-wah). This was all done while attempting to take classes at Orange County Community College (OCCC).

Yeah, not exactly the phoenix I had hoped, right? My path forward turned out to have a lot more twists and turns.

The acronym OCCC could be mistaken for a county jail for a reason. To the young and undisciplined me, that’s just what it felt like. I attended classes for the first month and a half but ended up dropping out during my first semester before the deadline for earning an F. This incomplete didn’t scar my school transcript, but it also didn’t make progress on my college plans or give any direction to my future. In fact, the only thing I earned was my first student loan debt.

Hi Stafford, so nice to meet you.

While in future semesters I did end up finishing a few classes at OCCC over the next few years, I never found my flow. I was just sleepwalking towards what I should do without the lust of ambition or direction. The Federal Stafford loans kept piling up, but as long as I was a student I didn’t have to start repayment. While I still lived at home, I had to make money to pay my living expenses, car insurance and gas so I took night shifts and worked around my class schedule. It was tough emotionally because it seemed like all my peers were either still in high school or out at a “real” college living it up. Plus, like many kids my age I had no real answer for my path forward.

Struggle Bus

My mornings would sometimes start at 7am pushing carts and cleaning bathrooms at Home Depot, include a mid-day class and end working a customer service job closing shift at the Newburgh Mall. While the hours were brutal I surprisingly had the endurance as each commitment was only a few hours long. My days flew by. My jobs earned me enough to start paying rent to my parents (not my idea but my parents were inspired after watching an episode of Ophrah about 30-something lawyers who lived at home for free), cover my car insurance, and added a few bills in my wallet. Most important, it was insufferable enough to force me to start planning a more prosperous future. I knew real life sucked. I knew I needed a path.

On my days off from work I started researching schools and applied on my own to Purchase College, the same state school my brother went to about a hour south of my hometown. Despite a shoddy SAT score, Purchase somehow accepted me to start my college life (again) the following September. I had hope. I had a way out and even started to form a vision for the future that I was excited to realize.

I continued to work throughout the summer and save up for my new life. Just before starting my first year of college my parents gifted back much of the rent I had paid them to help me start my first year at a four-year school. This was a tremendous gift—both financially and emotionally—and helped me make the transition to this new stage in my life. They also bought me a used Kia Sephia to help me with transportation.

After three years out in the real world, college was finally my new life. And luckily, I was hungry because I knew the alternative back in my hometown of pushing carts and answering customer service calls. This was not a future I wanted.

Finally Settling In

Getting to college, I knew I had just enough money to pay for one semester of tuition and room and board. My hope was to apply to become a resident assistant, or RA, scoring free housing and a meal plan. While it was unheard of that a Freshman would be admitted to the RA program, my cajoling must have hit the mark. Starting in the spring of my Freshman year I began a job as an RA and served in that role for the remainder of my time at Purchase College—another three years. Between this job, balancing classes, and additional jobs as a tour guide, event usher, and student housing janitor, my schedule was jam packed and I couldn’t love it more.

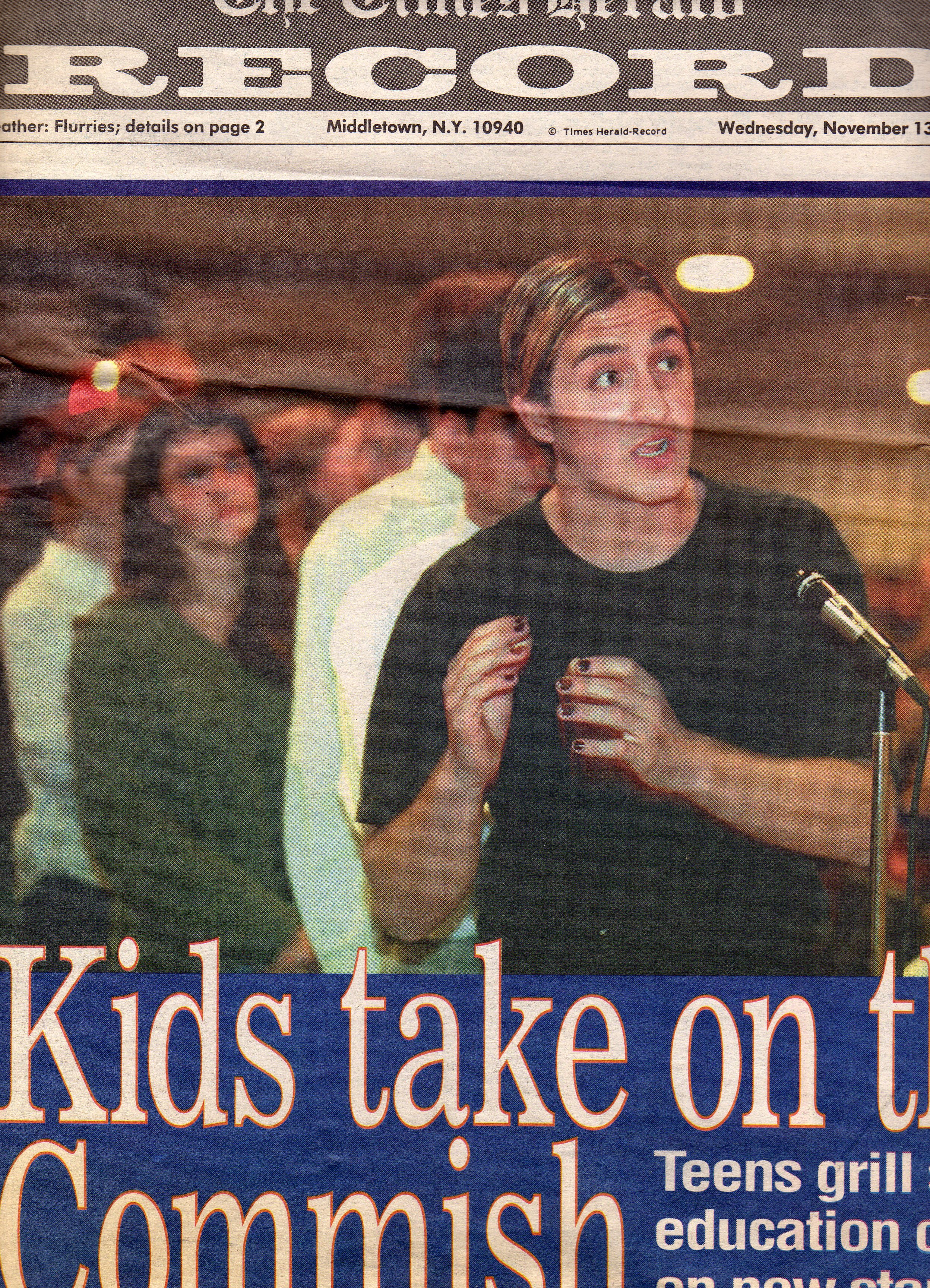

Like many young people, I was passionate about politics and spoke out about the war in Iraq while addressing my fellow students at our graduation commencement.

Like many young adults, my time in college was transformative. I went into it as a young person with limited academic skills, a lack of confidence and a limited understanding of myself. When I graduated four years later I was still flawed and had gaps in development, but I at least had some semblance of voice, direction and ability. I could code websites, and write essays, debate philosophy and edit films. My three internships exposed me to the corporate world and to life working for the Federal Government.

I had always been good at speaking up for myself and I had that too. The child who struggled to learn to read in elementary school a few decades before ended up pursuing studies in technology and communications. How cool is that?

I also graduated from Purchase College with $19,000 in student debt. Despite working jobs every summer, and throughout the academic year, tuition and fees had to be covered by Stafford Loans. I would have to immediately start paying them back after graduation (I had used the 6-month grace period years earlier while on a break from community college in the 90s).

…or I could pile on more debt.

I chose the latter partly because everyone said it was a good idea, but maybe equally because I was scared of the real world. Continuing my school meant I could delay adulthood. And to be fair, family member I mentioned my plan to thought grad school was a good idea and would eventually benefit me financially.

Digging in Deeper

That fall I moved with friends from Purchase College to Seattle, Washington and started pursuing a Masters in Communication in Digital Media at the University of Washington. This had the dual benefit of letting me gain more skills and an advanced degree and give me the breathing room to figure out how to convert studies to an occupation. However, this also meant that when I graduated a little over 18-months later, I had piled another $43,000 onto the debt that I carried from undergraduate school. At age 27, I now owed $63,000 (in 2005 dollars) to the Federal Government and had only just started my professional career. Looking at the monthly payment of $440+ was daunting, especially as I worked at a not-for-profit and earned $34,000 annually while living in a high-cost area.

Because of this I struggled financially, and not for just a few years. From 2005 through to 2013 I bit my nails trying to pay for my living expenses, and could never make another student loan payment beyond the minimal due. This meant that despite years of sending checks—and now in my early 30s—my total owned had barely crept below $60,000. Will it really take 30-years to pay this off?

Housing Crash

While I did buy a condo during this time, my original plan was to own it for four years and then sell at a profit to pay off the student debt. The only problem with this plan? I bought just after the first slump in the 2008 housing crash. Prices continued to slide over the next year as I watched my tiny bit of equity turn negative. In 2010 the economy was a wreck and I owned a condo that was now worth 30% less than what I had paid for it.

I bought all my clothes at Goodwill, shopped within a budget at Trader Joe’s, saved spare change to fund my music budget and drove my 1995 Honda Civic with a broken speedometer and 200K on the clock. However, no amount of saving was going to fix this pile of debt. In the eternal words of Dave Ramsey “I needed a bigger shovel”—a pay raise. I finally landed a job in the private sector with a marketing role at Brooks Running Company and earned a solid $52,000. This was a giant pay bump, but rising rents meant that my budget was still extremely tight. My partner at the time also struggling financially and often couldn’t contribute to rent or living costs. I ended up moving out of the condo I owned and rented it out. We downsizing to a one bedroom daylight basement apartment with utilities included for $1,050/month. Maybe this would take some pressure off?

I remember trying to get a hotel room for one night after a windstorm blew our tent over and forced us to retreat from camping and find shelter. When I checked my bank account while standing in the hotel lobby, I realized I literally had no money left to pay and no credit cards to access. Luckily my partner at that time still had $200 in her bank account so she rented the room with $100 to spare. This is just one of dozens of stories I could tell about penny pinching and financial struggles spanning my 20s and 30s. Obviously this example was not the most dramatic—I never missed a meal or had a medical condition I couldn’t afford, but the lessons I learned during this time have stuck with me even many years later. I clearly recall the sting of worry when even a tiny unexpected cost like a parking ticket fell my way.

Now 26, I was transformed from when I started college (after OCCC) six years earlier. However, I also was in serious debt—racked up $63,000 in student loans and didn’t have a high income job waiting to pay them down.

No Easy Way Out of Hell

Following a job change and then a bought of unemployment, I eventually landing a job at Expedia HQ in Bellevue, Wa. There I worked in employer branding and digital marketing and finally saw a pay bump and stabilization in living costs that allowed me to live a less spartal life. I was finally able to start putting extra funds against my debt, and shop at grocery stores adding anything I wanted to the cart. Despite the pay bump to a now whopping $105,000, it really wasn’t until I started a new role at BECU, a leading credit union, that I lopped off bigger and bigger chunks of my debt. Through extra payments and intention I whittled my student loan debt down to $30,000 in 2020, and then to $20,000 in 2021. I then used savings and an annual bonus to finally put this debt monster to bed last year. I attempted to calculate the total that I paid to the government (principal and interest), but when my calculations started to far exceed the original $62,000 loan, I felt nausea and setting on “I paid them a LOT.”

After years of owning the condo, I sold it. Eventually I moved to the South Puget Sound and bought two houses including our current home in Lakewood. For the first time I landed a home with multiple bathrooms! WOO-HOO.

After living in homes plagued by police and fire sirens for years, I finally made it to a place of peace and nature steps from my door. I am grateful.

Lessons Learned

College is Amazing. Do Everything

I love learning and have no regrets that I pursued at least my undergraduate degree. I’ve been able to leverage these studies and knowledge into doing and learning amazing things and building lifelong relationships. I have no regrets on that use of time. However, I don’t think enough time or attention is paid by parents, students or society on the hazards that debt can create. This leads me to my second point.

Debt Carries a Cost. Too

In total, I carried this debt from 1998 and didn’t pay it off until I was 39 in the spring of 2021. While I am immensely grateful for the life that I’ve been able to realize in the Pacific Northwest, and for the relationships I still sustain from college and grad school, I don’t know if I would recommend the path I took. Debt very likely has limited my career, life opportunities and maybe even delayed me from having a family. During my 20s in particular I couldn’t move to another city or extend a job search to find the right role because I just needed a job because that debt payment was due on the first of the month.

If I had been more creative, strategic or academically talented, I might have had my undergraduate and maybe even graduate school paid for. It was only after going through both when I met other students who had their tuition covered due to their military service, or from grants, scholarships or benefits from their employer. To any student thinking about college, I highly suggest you first exhaust no-cost options for schooling. Yes, getting a college degree will over your lifetime increase your earning potential, but it will be even better if you can figure out how you can get that degree without acquiring a debt monster.

Refinance & Pay Extra

I waited for twenty years to refinance my student loans to lower rates because I knew that the Federal debt could be paused (with interest) if I was unemployed. However, if I would have had more confidence I could have chopped my interest rates in half. Instead of 6% I could have seen 3% or less years earlier due to rates being at multi-decade lows compared to the late 1990s or early 2000s. I let fear be my driver. Don’t. Most private loans also allow for hardship pauses in payments as well. I should have done my homework and researched my options years earlier.

Also, I should have made a stronger effort to pay anything extra I had to the loans. Even $50/month plus an annual tax refund could have dramatically shortened my repayment time. It may not feel that way when you’re looking at a giant sum owed, but every little extra payment matters.

Live Well Below Your Means

I was thrifty in college. But there were also unnecessary splurges, too. I bought an iPhone on launch day, learned to ride and picked up a motorcycle in Seattle, opted to own a condo instead of renting a room in a house with friends, and didn’t have a plan to pay more than the minimum payment for a 30-year payment schedule. This fundamentally meant I’d be paying tens of thousands in interest instead of depositing that in savings or investing in my retirement.

In retrospect, I should not have gone to grad school and probably would have been better off getting a job with a corporation or government first. I’d have a few years to build my resume and bank account. Maybe I’d even earn a tuition reimbursement? I should have also considered taking a part-time job and using 100% of the extra funds to pay off my debt. Plus, I probably should have skipped owning a car in college too. The insurance payments are extreme when you are a young male and bus lines are likely not far from school or the supermarket.

So in closing, student loan debt is a giant burden to put on a young person. While I prize education, I think education debt is exactly the worst way to start off an adult life. But maybe it’s the least worst option? Over 44MM Americans carry some type of student loan debt totalling $1.86T. Considering that even in-state annual tuition and fees top $12,000 (that’s before books, room and board and spending money), I don’t have a great solution for the young person yearning to get a degree but without the gusto for military service or academic chops. I just caution you to do much more homework before signing for a Stafford Loan.

You have options. The “easy” way out may not be that easy. The last two decades for me are proof of that.